Geoffrey Gabor (GG): I’d like to start by thanking you, Congressman Ryan, for granting us this interview. Your press secretary informed our production crew that you receive hundreds of interview requests weekly.

Paul Ryan (PR): It is my pleasure, Geoff.

GG: I can’t think of a more appropriate place to conduct this interview than in Congress’ Budget Committee Conference Room at The Cannon House Government Building directly across the street from our nation’s Capitol.

American Business Magazine is the brainchild of top consulting firms Corporate Business Solutions, Global Resources, Strategic Tax Advisors and GPS. These firms have joined forces to create a magazine that targets an entrepreneurial demographic. Our mission is to provide timely information and valuable insight.

We unanimously agreed that an interview with you would greatly benefit our readers because of the collateral impact the nation’s debt has on the economy and business.

You’ve been described as the nation’s accountant. There have been acclamations from both sides of the political aisle. Where did you acquire your acumen?

PR: Actually, I’ve always had a strong desire to understand economics—it has been my life’s ambition. When I was younger, I wanted to become an economist. Originally, I thought about attending the University of Chicago to get my doctorate and go into the field of economics. But after receiving my undergraduate degree in economics, I took a temporary position as a staff economic researcher in the Senate at the nation’s capital. So, I guess my life’s path took a different direction.

I eventually ended up working for Jack Kemp as an economics staffer and speech writer. This caused me to become more and more involved in public economics and public policy. I’ve always had a love for economics and have been reading the federal budget since I was 22 years old. It might be hard for some to understand, but economics has always been a passion for me. It’s something I’ve been deeply interested and involved in ever since I finished school.

GG: It’s been said you have an uncanny ability to recall metrics with photographic accuracy. Do you have a photographic memory?

PR: I’m pretty good at remembering numbers and things like that. It’s an area that I dedicate a lot of my mind to. I guess it’s an aptitude thing, but I enjoy numbers so that has something to do with it, as well.

GG: How would you rate Congress and the executive branch when it comes to their understanding of generally accepted accounting principles (GAAP)? Does a lack of financial ability in Congress contribute to some of the difficulties we’re having?

PR: That’s a bit of a trick question, Geoff. The way the government does its accounting is unlike anything you will ever find anywhere else. If any privately held or publicly traded business did their books like Washington does, they would have been in jail a long time ago—forget about Sarbanes-Oxley. The government has a very convoluted system and a surprising amount of people in Washington don’t quite understand how it works. I would argue this system was devised, for the most part, to proactively grow government. It was crafted around 1974 to have an inherent bias to favor more spending, which would be supported by increasing taxes. The system is designed to make it easier for the government to borrow money. In other words, it makes it easier to debt finance as compared to any other method.

GG: Can you expand on the differences between how accounting is performed in the business world versus how the government balances its books? Our readership determines their business’ breakeven point when gross profit overtakes fixed costs. How do lawmakers determine breakeven in government?

PR: We don’t have EBITA in the federal government or anything like that. The problem with government is:

- We can print our own money;

- We’re the world’s reserve currency so we can borrow a lot of money; and

- Politicians run the place.

That means most people from both political parties do well politically by making a lot of empty promises to voters. It’s not politically advantageous to take something away from one’s constituency. There’s a risk when being candid about the true nature of our fiscal problems and what it’s going to take to fix these things. Politics is typically rewarded to the politician who makes the empty promise(s), and politicians are typically penalized when they try to fix problems, or when they speak candidly with voters about any potential sacrifices.

GG: Congressman, do you perceive an inherent weakness with Congress’ and the executive branch’s understanding of macro impact when balancing inflation risks to recession risks? Is this part of the problem?

PR: Definitely! All you have to do is look at the direction of our economic policy, our fiscal policy and our monetary policy. It’s a systematic replacement of the rule of law with the rule of man. I know, in part, it’s a philosophical and political thing to say, but nevertheless, it’s what we’re doing. We’re taking our country’s monetary policy and fiscal policy off the moors. We are deviating from any standards of acceptable behavior. Monetary policy is excessively discretionary and that keeps markets guessing as to what our currency is going to look like. It makes it impossible to predict the reliability of money’s store value. Therefore, it creates uncertainty as to where our inflation is headed or what things are going to look like in the future.

Simply put, our fiscal policy has become a matter of borrowing way beyond our means. We’re spending money we don’t have, as 42 cents on every dollar is borrowed and 47 percent of that is borrowed from other countries. Our fiscal policy is on this massive collision course with our monetary policy. At the end of the day, if we don’t get this set, monetization will not be the worst option. That would be a tragic mistake. I see massive uncertainty being injected into the economy because of government activism and the government’s lack of adherence to core standards and principle.

GG: Do you perceive any possibility forstalling potential benefits from the stimulus package by constricting spending in order to get deficits under control?

PR: None.

GG: You don’t perceive any risk?

PR: No, I don’t. I don’t subscribe to the “demand side” school of thought. Actually, I would take the contrary point of view. If we made real cuts to spending and got it under control, that would be a good thing for our economy. That would be a good thing for the credit markets, it would help stabilize interest rates and it would take pressure off monetary policy. It’s simple: Every big deficit we run today translates into higher taxes or interest rates tomorrow.

GG: How prodigious an indicator is the Moody’s and Standard & Poor’s predictions regarding the country’s bond rating degradation?

PR: The Standard & Poor’s warning was all about political leadership. It wasn’t as much of an accounting statement as it was a statement that Washington is messed up and that it doesn’t look like they’re going to do anything meaningful to get it fixed. So, we’re changing – we’re contending with a downgrade from credible. We’re going from stable to negative. Standard & Poor’s made their conclusion based upon the fact that our fiscal authorities are not doing their job of getting things under control.

GG: Are you predicting the United States to be a debt risk?

PR: Yes, we are a debt risk. We have talked to a lot of those in the bond markets – a lot of authorities in the bond markets – in conjunction with many economists. They all tell us we have about two to five years. Most say less than five years. Quite frankly, that scares me. This is why we’re putting the budget out. I know it’s not politically expedient, but it’s what needs to be done. This is why, at the end of the day, we have to look ourselves in the mirror. We need to be able to look our children and constituents in the eyes and know we did the right thing. It’s vital to our country’s future to be on the right side of history. It’s obvious there is a debt crisis coming. Our goal and hope is to try to preempt in order to prevent a debt crisis. We don’t have European austerity yet, but this is what we will have to impose in the midst of a debt crisis. We’re the world’s reserve currency and the volatility is increasing. This is what other sovereigns are facing. The problem is exasperated by ideology and politics, which makes it very difficult to make any substantial achievement in getting our fiscal policy under control.

GG: Do you see a shared culpability between all political parties?

PR: Yes, absolutely. All parties are to blame for this. Let’s stop trying to point fingers and, instead, simply fess up to the fact that all political parties have screwed this up. We need to look forward and try and fix this problem together. That’s why we put out a budget that, according to the Congress Budget Office, pays off the national debt. It does more than balance our budget—with time, it pays off the debt and evaporates the interest on that debt.

GG: Do you see any willingness from members of Congress to sacrifice their potential reelection in order to do what’s best for the nation?

PR: This is where I might get a little partisan, but I believe the Republicans are there, especially in the House. We have added 87 freshmen congressmen and congresswomen to our ranks that believe more in a cause than initiating political careers. The last Republican majority prior to 2006 contained too many members that were more concerned about their political careers than about America. They were worried about the next election, not the next generation. I think today the cause is genuine by virtue of the fact that we just passed very comprehensive Medicare reform in our budget – $6.2 trillion in spending cuts. That may not be politically expedient, but it’s vital to our future.

Former Speaker Dennis Hastert and I had dinner two years ago. Dennis told me the hardest thing he had to pass during his entire eight years as speaker was what they called the Deficit Reduction Act of 2005. The bill cut $40 billion over five years. We recently passed a bill with ease, cutting $6.2 trillion over 10 years. I think the Tea Party was a big help in putting what’s needed ahead of what’s politically safe. We see the fiscal cliff ahead of us. We realize this is not about our careers – this is about the American ideal and American exceptionalism.

We’re proposing solutions and putting ideas out there. We’re getting savaged and demagogued by the left. There is a plethora of scare tactic TV ads inaccurately portraying and misrepresenting the truth. I think the president and his party made a decision not to negotiate or compromise with us on these big problems facing us because they can’t resist the temptation to use our proposed solutions as their political weapons in order to position themselves for the next election. Unfortunately, this means we might have to go and fight most of this out over 2012.

GG: How would you define political braveness?

PR: I think political braveness is looking constituents in the eyes and telling them the hard truth: what’s going on with the federal government and their finances, how Medicare is going bankrupt, how our debt is unsustainable. Political braveness is putting out actual ideas, actual budgets and actual plans to prevent a debt crisis. Reforming government programs by virtue of cutting and capping spending is what needs to be enacted to promote economic growth.

One thing I don’t want to leave out of our discussion, Geoff, is this is not just a green eyeshade experiment of math and accounting. It’s not just cutting and controlling spending. We must have economic growth. We must have job creation. This is a cornerstone of our economic plan, our budget and our policies aimed at pro-growth, or policies that get the economy growing. Spending cuts and reforms and economic growth are what we’re trying to achieve. So, that to me is the key ingredient. We believe we owe it to the public – to our constituents – to give them specifics, try and win this argument and get the country to understand where we are. We see that as leadership and not naivety. What we expected is what we’re getting—that being a torrent of negative ads trying to scare seniors in order to influence the next election. If we allow them to succeed at this, then we will have lost the next generation as far as I’m concerned.

GG: Both you and Wisconsin Governor Scott Walker display common boldness. I was wondering if that has anything to do with growing up in Wisconsin within a few miles of each other. You’re both mavericks – about the same age – that grew up in the Reagan era. Do you think that contributes to this common likeness?

PR: Yes, we grew up about 15 miles from each other during the Reagan era. President Reagan was a model leader that we saw and experienced growing up. So, yes you could say that influenced us. Scott and I know each other extremely well and I believe he would agree with that, too. I’ve had mentors throughout my life – I lost my dad when I was young. The mentors I’ve had were bold leadership types. Jack Kemp was a big political mentor, along with Bill Bennett. I worked for them for a number of years.

GG: How has the enormity of being catapulted into the spotlight affected you and your family?

PR: My family is behind me. We have young children – six, seven and nine years old. My wife knows this is what I was meant to do and what I’m wired for. I believe this is my purpose for this moment in history. It’s sort of in my DNA. I’ve been looking at this problem, thinking about this problem and putting bills out for years. I put out the first roadmap for America’s future – a bill to pay off the debt and get the economy growing. When we proposed reforming our entitlements in 2008, I got eight co-sponsors. In 2010, I put out similar legislation and had 13 co-sponsors. This year, we wrote a budget accomplishing the same goals and missions of those roadmaps and we got 239 votes. It’s now the Republican budget. My wife understands the importance of what we are doing and the personal sacrifice involved.

We’ve dramatically moved and shifted the national debate. We are the party that’s serious about tackling this debt threat and reforming entitlement programs before they implode, while working to get this economy growing again.

GG: I interviewed Donald Trump for American Business Magazine at his Fifth Avenue Trump Tower boardroom several months ago. During that interview, he indicated he was receiving increasing pressure to run for president. How much pressure are you receiving to run since Trump, Mike Huckabee and Mitch Daniels have declined to run?

PR: The pressure has increased since Mitch Daniels announced he was not running. Mitch and I are kind of kindred souls. The people who were supporting him are calling me these days. I have never envisioned running for president. I’ve always seen myself as more a policy person and less a political person. Obviously, I’m a politician so, clearly, I’m in part political, but that’s not why I decided to do this. I wanted to get engaged in the battle of ideas in public policy. This was not intended to be a pathway.

GG: What would it take for you to reconsider?

PR: Gosh, I don’t know the answer to that question. What I get, though, is that people are really hungry for honest, sincere, actual leadership and we’re not getting that right now. People know that the economy, the country, the American ideal is really up for grabs, and I fundamentally believe that. I think the entire American ideal – equal opportunity, economic growth, prosperity, upward mobility – is being jeopardized because of our economic policy today.

GG: There was a Foreign Affairs Committee meeting pertaining to the Libyan situation in this very room moments ago. We had to wait in the hallway for the committee to adjourn before we could interview you. This may not have the grandiosity of Trump’s boardroom but you can certainly feel the unfathomable importance of the room we are in.

PR: This is the House Committee room. This is where we actually write the budget. We spend hours in this room as a committee writing all of this.

GG: During a few of my meetings with Ben Stein, he reluctantly told me he doesn’t see any way out of the deficit without increasing taxes on the wealthy. What are your thoughts?

PR: Ben Stein’s dad was an economist – I’ve read his textbooks. I think that’s probably the school of thought Ben comes from. I don’t really know Ben Stein well, so I’m not going to say what he thinks. Here’s the problem with that logic, though. Let’s assume we take the president’s argument that we should tax the wealthy, which are those that, by his definition, earn about $200,000 and/or couples earning above $250,000, including all small businesses. If we taxed at a rate of 100 percent from that income group, it would fund the government for approximately two months. If we also took all the profits of all Fortune 500 companies, it would run our government for about 40 days. Ten years of tax increases on the top two brackets the president is calling for – all that revenue would simply help us pay off only one-half of this year’s budget deficit.

The point is, there’s not enough money there to tax, regardless. What this would actually do is hurt growth and, therefore, our economy. This is not the same old 20th century any more. America is not the undisputed economic superpower of the world. We have to compete, meaning we have to be competitive. And, when we tax our businesses considerably more than our foreign competitors are taxing theirs, they win and we lose.

I’m worried we have entered into a new political era, led by President Obama, of class warfare. You can call it “envy economics.” We’re pitting people against each other – the U.S. is actually disparaging success. The government is stifling risk taking, entrepreneurship and achievement. I believe this is flawed from a moral standpoint and from a social cohesion standpoint, but, overall, it’s really bad economics. We need to have more fundamental tax reform. Tax rates must be lowered in exchange for broadening tax base means, and there must be a decrease in the amount of tax shelters for people to park their income overseas. Overall, we need to have a more globally competitive tax system.

GG: What would you do to limit or slow the migration of domestic business overseas?

PR: I would go to a territorial tax system. We should make the top American tax rate 25 percent for individuals and businesses. As you know, all the partnerships and LLCs are taxed at the individual rate. What the past Republican budget says is bring those tax rates down to 25 percent on the corporate side, as well. I think we’re shooting ourselves in the foot the way we tax ourselves. The rest of the world has moved toward a territorial system and we have not.

I just met with the chief of staff to the Council in Britain who stated not only have they just moved to a territorial system, they’re moving their top tax rate on businesses down to 23 percent. Ireland is at 12.5 percent. The international average corporate tax rate is 25 percent. We are the highest now at 35 percent. So, we are, literally, pushing capital overseas. Corporations are looking overseas and the U.S. government is making it impossible for them to come back with their capital. That’s giving an incentive to keep capital overseas, not to domicile your company here, and we’re making ourselves ripe for takeover targets. Foreign companies are taking over U.S. companies. This is occurring at an alarming pace—eventually the loyalties of these corporations will leave, as well.

I think we need to have a tax system that makes America a haven for capital formation. Let’s make this country a tax shelter for other countries instead of having other countries be a tax shelter for America. This would ultimately raise revenues and promote economic growth.

The way we should look at increasing revenues to the government should not be class warfare or a bigger than ever tax increase approach. Economic growth comes from job creation and better economic growth policies that raise revenue through higher growth. Lowering tax rates at a broader base of income brings in more revenues and would help us close our fiscal gap.

GG: Years ago, there was some benefit from a balance between conservatism and liberalism – a yin and yang. The balance appears to have been replaced with mean-spiritedness. Do you see that getting in the way of fiscal sanity?

PR: Yes, I do. It’s bitter partisanship these days. It’s kind of character assassination. I’m not trying to pick on the president, but what’s happening is the “hope and change” mantra we heard before is being replaced with class warfare. There has been some preying on the emotions of fear and anxiety—there’s a lot of that in America, today. Too many are trying to profit off of fear and misrepresentation that divides people and speaks to worse qualities in people. We should be focusing on growth, on opportunity, on upper mobility, on job creation and on economic growth.

GG: There’s been some controversy over the Medicare and Medicaid proposals you have offered. Explain why you think it’s better than a single-payer program. How are they different?

PR: To begin, my proposals are polar opposites of a single-payer program. With a single-payer program, the government is the payer and runs all of the healthcare system. Meaning, the federal government decides how healthcare works and how healthcare is to be reimbursed. They decide how insurance works and what kind of medicine physicians can practice. They decide on all the funding formulas. To me, it’s a fatal conceit. Furthermore, wherever this has been tried, it didn’t work. Ultimately, it forces imposing global budgets because when anything becomes a free good, it will continue to be consumed and over utilized because there’s no connection between the seller and the buyer. In the end, there’s not enough left for the consumers and what you’re forced to do is ration care, which leads to long waiting lines.

What we’re proposing is a patient-centered healthcare system. Specifically, what we’re saying is, let’s do this in a gradual way. For instance, there will be no changes to Medicare for anyone who’s above the age of 55. We believe we can cash flow that commitment. The promise that government has made to people 55 and above who have already retired and organized their lives around this commitment needs to remain intact. We believe we can do this through the reforming programs and budgets from my generation, or those of us 54 and below.

The way we propose to reform healthcare has had bipartisan support in years past. This is not the first time this concept has been offered. It’s the kind of system President Clinton’s commission recommended and called “premium support.” Consider Medicare as a list of guaranteed coverage options—pre-approved plans from Medicare that are private plans competing against each other for seniors’ business. We would subsidize the person’s plan based on who they are. For instance, if they’re wealthy, they don’t get as much of a subsidy as those in the low to middle income range. And, if they’re sick or low income, they get a much higher subsidy. Doing it this way helps create choice in competition and it puts the senior beneficiary in charge instead of the government.

GG: Why do you think some equate this proposal with pushing seniors off of cliffs?

PR: The television ad you’re referring to depicts me pushing an elderly woman off a cliff. That’s what we call Mediscare. These political tactics are aimed at trying to scare and intimidate seniors. It’s irreprehensible to distort the truth in order to exploit seniors’ fears to profit politically in an election.

GG: How likely is the outcome of ObamaCare to become a single-payer system?

PR: I think it was always designed to become a single-payer system. ObamaCare puts a panel of 15 bureaucrats who aren’t elected and aren’t accountable in charge of our Medicare next year. They don’t go through Congress – they simply impose price controls directly. So, that helps put the government in charge of how the system works.

All the business owners reading this interview and everyone under 65 should understand ObamaCare’s goal. If your company doesn’t provide the exact kind of insurance that ObamaCare says you must offer to your employees, then you’ve got to pay a $3,000 fine per employee. If you decide to drop healthcare for your employees, you can avoid that fine by placing your people on the government exchange program plan, costing you $2,000 per employee, or $1,000 less per employee. What do you think the incentive structure of that is? This incentive causes employers to not want to provide insurance. It’s designed by intention to evolve into a single-payer government program.

It’s more evident when you consider that people in the federal exchange coverage – who are getting federally regulated and run health insurance – will reimburse providers at a lower rate. This costs private payers more for employer-sponsored health insurance to make up shortfalls even though there is no difference in benefits if an employer elects government exchange or private payer.

GG: Do you think it’s sustainable?

PR: No, I think it’s going to collapse under its own weight. I think it’s unsustainable. The Medicare actuary just told us that insolvency has moved up five years. They think 40 percent of Medicare providers will go out of business or stop taking Medicare.

GG: I want to thank you very much for this interview, Paul.

PR: It was my pleasure, Geoff.

About Paul Ryan

Born and raised in the community of Janesville, Wisc., Paul Ryan is a fifth-generation Wisconsin native. Currently serving his seventh term as a Member of Congress, Paul works to address the many important issues affecting Wisconsin residents and serve as an effective advocate for the 1st Congressional District.He is the Chairman of the House Budget Committee, where he works to bring fiscal discipline and accountability to the federal government. He is a senior member of the House Ways and Means Committee, which has jurisdiction over tax policy, Social Security, healthcare and trade laws.

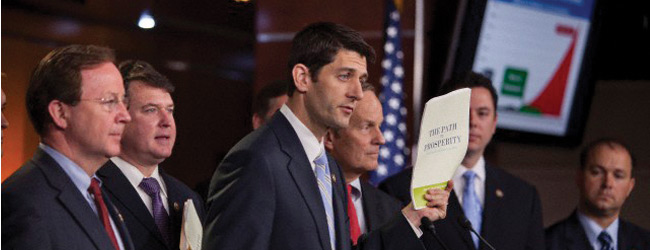

Paul has put forward a specific plan to tackle our looming fiscal crisis, driven by the explosion of entitlement spending. The Path to Prosperity helps spur job creation today, stops spending money the government doesn’t have, and lifts the crushing burden of debt. This plan puts the budget on the path to balance and the economy on the path to prosperity.

Paul is a graduate of Joseph A. Craig High School in Janesville and earned a degree in economics and political science from Miami University in Ohio. Paul and his wife Janna live in Janesville with their three children.

Source: www.paulryan.house.gov

………….a birds view ………..anything different!

Great interview. Would love to see him as our nxt president